Eric John: Tips for the future of Ad-Supported Streaming

The head of the IAB Media Center shares insights from This year’s Video Leadership Summit.

By Eric John

At the beginning of this year, Netflix surprised Wall Street with an earnings report that sent shock waves throughout the streaming video industry. While the company’s revenues and profits were in line with expectations, its shares plunged on news of slowing subscriber growth. It was clear that we had entered a new era of the streaming wars when Netflix CEO Reed Hastings stated: “We’re looking to figure out advertising over the next year or two.”

The announcement sparked a wave of speculation and rumors as to who—and what—might be needed to aid the company in its mission to build out an ad-supported business. By Q2, the streaming bubble had further deflated as Netflix announced it lost a million more subscribers (in addition to the 250,000 subscribers lost in Q1). Roku also sounded an alarm bell, citing weakness in ad spend.

Other streaming services, however, seemed to be telling a different story. Rumors that the global streaming audience had reached saturation were proven wrong as Disney announced it had exceeded expectations for subscribers for the Disney+ service, surpassing Netflix in terms of total subs. Disney now has over 221 million total subscribers across ESPN+, Hulu and Disney+, though they have lowered their 2024 total subscriber guidance to between 215 to 245 million (down from 230 million to 260 million). They also expect their streaming business to be profitable by 2024.

Interestingly, despite losing subscribers, Netflix's streaming business is profitable today (and has been since 2006). Netflix Q2 revenues rose 9% from this time last year. Some analysts expect that the addition of an ad-supported tier will not only open the service to new price-sensitive audiences but also increase ARPU (average revenue per US user), potentially to $10 per user per month.

But how exactly will Netflix thread the ad-supported needle? For executives who gathered at IAB’s Video Leadership Summit in Santa Monica this past July, Netflix’s challenges served as a “blank slate” opportunity to examine not only what Netflix, but every streaming service needs to do to grow audience, revenue per user, and future-proof their content offerings.

The summary below of those executives’ insights provides food for thought as the battle for the attention—and wallets—of viewers continues to play out. In some cases, our VLS participant’s suggestions (in quotes below) foreshadowed recent Netflix news and announcements, including:

“Partner with an ad tech provider that doesn’t offer a competing streaming service.”

As it turns out, Microsoft got the job, which in hindsight, makes a lot of sense. Microsoft’s X-Box gaming content and franchises like Minecraft, Halo, and Fallout are more complementary than competitive with Netflix’s long-form premium content offerings.

“Hire senior ad executives who understand the needs of both brand and performance advertisers.”

Netflix announced on August 30th that Jeremi Gorman and Peter Naylor—both previously at Snap and both with previous roles in television and streaming TV advertising—will be leading Netflix’s advertising efforts.

“Tackle the challenge of over-frequency head-on.”

According to a Wall Street Journal article, Netflix will be limiting – at least in the short term – the amount that any one advertiser can spend on Netflix to $20MM per year in order to ensure there is no over-frequency by any particular brand or advertiser.

“Focus initially on upper funnel, brand advertisers.”

Netflix has, according to the Wall Street Journal, begun courting TV advertisers with a goal of locking in year-long commitments at fairly high CPMs ($65/thousand impressions).

“Differentiate the service with a lighter ad load.”

Netflix will be limiting their ad load to just four minutes per hour, creating a more friendly experience for viewers. Only Peacock has committed to a similar level of reduced advertising. By contrast, traditional TV ad loads range between 18 minutes and 23 minutes an hour.

“While Netflix has lots of user data, restrictions are growing (not only internationally with GDPR but with new individual state regulations). Better to start with limited targeting and learn what works from there.”

Netflix will be launching its ad offering with limited targeting and options including viewers watching Netflix’s top 10 shows in the US, people watching a specific genre of show (comedy, drama, etc.), and country-level geo-targeting.

“Netflix's ultimate challenge is how to develop an ad model that drives enough revenue to attract a consumer at a lower price.”

Plenty of questions remain as to what Netflix ad offering will ultimately look like and where the initial ad dollars will come from. Will it be from TV’s traditional top 250? Or from emerging brands we see on Hulu, Tubi, Peacock, or Pluto? One thing’s for sure, Netflix will be one of the most highly anticipated presenters at this year’s IAB Newfronts. After all, what brand wouldn’t want to be in front of 220 million fans of “Stranger Things”?

Other considerations and suggestions for any streaming service:

The wisdom of multiple revenue streams: With increased competition coming from more streaming services, and as the costs of producing hits eat into profits, the streaming service landscape is shifting towards the safety of multiple revenue streams, exemplified by Netflix’s pivot from subscription-only to the addition of an ad-supported tier. The new – still to be named – ad-supported service is expected to launch with Microsoft now supplying the necessary ad tech.

Interestingly, none of the VLS attendees predicted the Microsoft partnership (though everyone pointed to the need for them to partner, as opposed to building a proprietary ad tech stack from scratch). Most people thought Netflix’s partner of choice would either be Comcast or Google.

So why did Netflix partner with Microsoft in the end? The fact that Microsoft doesn't have a legacy streaming business certainly helped. In a statement announcing the deal, Netflix wrote, "Microsoft has the proven ability to support all our advertising needs as we work together to build a new ad-supported offering," adding that the company offered strong privacy protection as well as "flexibility to innovate over time on both the technology and sales," In addition, given the global reach of the Netflix audience, Microsoft is well suited to handle their global requirements and needs.

Most VLS attendees cheered Netflix’s shift to an ad-supported model, seeing it as a net benefit to the market, bringing more high-quality ad inventory for advertisers to purchase. As one participant pointed out, “The scale of Netflix will be extremely important for brands.” When you consider Netflix still has 220MM subscribers worldwide (plus 100MM people who are sharing passwords), that means 320MM households are engaging with Netflix. It’s no wonder advertisers are champing at the bit.

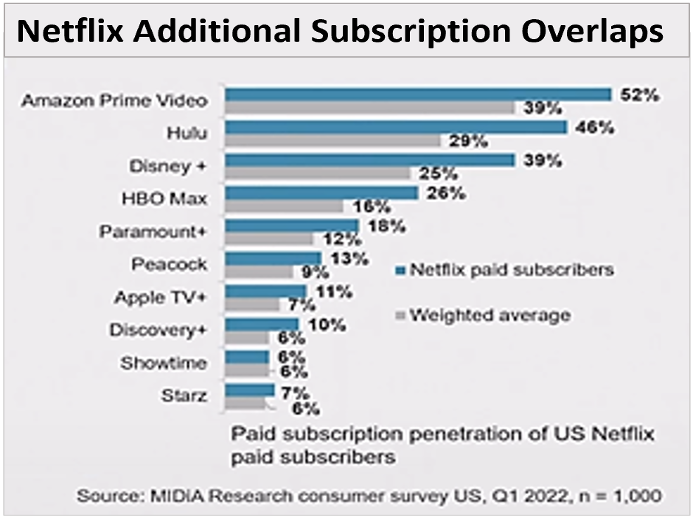

Are there too many streaming services? In addition to Netflix, there's Hulu, HBO Max, Amazon Prime Video, Peacock, Paramount+, Disney+, Apple TV+, ESPN+, not to mention the FAST (Free Ad Supported Services) such as Tubi, Roku Channels, Samsung TV Plus, LG Channels, etc. One concern is audience overlap. As Laura Martin, Senior Analyst and General Manager with Needham & Co pointed out in her “state of streaming” keynote, “a huge percentage of Netflix subscribers not only have cable, 52% of them also have Amazon Prime, and 46% also have Hulu.

The last thing a service wants is churn (people canceling and switching to another service at the click of a button). “Once you leave a streaming app, you become fair game for every other app. Substitution is a lot easier when you have five other services to choose from.“

Content is king (but nothing beats free and cheap): According to a recent Comcast survey, 69% of CTV households today say they would consider replacing a paid service with an ad-supported service. That’s good news for all the AVOD and FAST Services, but the question remains – given the paradox of choice--how are audiences choosing? In the early days of streaming, it was easier for Netflix to build a compelling content offering through syndication.

Today, Netflix has lost the rights to stream content from multiple networks, including Paramount, NBCU, and AMC) that have launched their own streaming services, choosing to distribute their content through those services instead of licensing to Netflix. This has forced Netflix to invest billions ($17 BN in 2021) in creating original content, with varying levels of success. Today each streaming platform is looking to differentiate itself by offering a specific set of shows and movies. It all comes down to what people are willing to pay to watch. In the midst of a recession, more and more households will no doubt be looking more closely at their streaming service bills.

Quality versus Quantity: While Netflix has had its share of hits (including Squid Games and season 4 of “Stranger Things,” which generated 1.3 billion hours viewed in the first four weeks of its release), many of its shows and movies have been less than stellar. As one VLS pundit stated: “The company seems to be investing in quantity rather than quality, hoping that some of its titles will be successful.” Given the economic uncertainties today, what Wall Street cares about now more than ever is a return on invested capital. In the case of streaming services, it’s a return on invested content spend. The chart below, Laura Martin also shared, highlights that Netflix produced over half of the original content released in 2021. By contrast, Disney+ released half as much but produced a similar level of marketplace viewing. Of course, it doesn’t hurt having a massive back-catalog of content and the mindshare of nearly every parent with kids in the house. For an ad-supported business driven by time spent, the key question for Netflix will be, can it generate the quality of content needed to reduce churn and keep viewers engaged? If viewers are not pleased with what is available, they'll simply “watch, cancel and go” (to another service).

Whether Netflix (or any streaming service) will be successful will have as much to do with the ad experience as the content experience. Will they succeed in creating a different, less intrusive ad experience that will be palatable for an audience used to not seeing ads? The VLS participants agreed across the board that ad load and ad frequency would be key.

But what will the advertising actually look like? Will commercials appear before, between, or after episodes? As one participant pointed out: “The ad experience is going to vary based on the type of content you're watching, whether it’s a movie or TV. It’ll depend on the type of customer profile you have, how active the viewer is, and what device they're on.”

One thing that was clear to everyone was that Microsoft—who purchased the Xandr ad serving solution from AT&T to bolster their connected TV ad business—will need to provide dynamic capabilities and enable the team to learn how to harmonize the customer experience with the revenue experience. “I would expect they’ll start a little lighter and then build up into an optimal balance that’s good for both monetization and the viewer.

The last thing a service wants is churn. “Once you leave a streaming app, you become fair game for every other app. Substitution is a lot easier when you have five other services to choose from.”

Netflix's ultimate challenge is how to develop an ad model that drives enough revenue to attract a consumer at a lower price. Some VLS participants felt Netflix should leverage the combination of a higher CPM and a lower ad load. Others felt that since sponsorship is already part of the Netflix business model, those integrations should be further scaled through more advanced attribution modeling.

Still, others felt that over time, Netflix could build a very robust ecommerce and game subscription business, tapping, for instance, the gamer audience that Microsoft has successfully grown through its X-Box and Minecraft businesses and leveraging e-tail rights in the content they're distributing:

Building an ad sales and media analytics org from scratch. The “wash, rinse, repeat” real-time sequence of planning, executing, and optimizing campaigns has evolved over the past 5-7 years with the meteoric growth of CTV. Netflix will need to rethink its current corporate culture and team structures to bring the creation of new ad products, campaign planning, and execution closer together, leveraging new workflows, data, tech, and measurement on behalf of its clients and brands.

Currencies and measurement. Don’t expect the ad business to scale right out of the gate. There may be limited inventory initially, so focus on the audience-based and impression-based currencies already in use. “Align with how buyers and brands are measuring ROI in CTV so that Netflix campaigns can be readily combined with everything else buyers are doing in the marketplace.”

Smart TVs deserve smart creative: CTV ad effectiveness requires more than just repurposing the same 30-second linear TV spot into targeted CTV environments. Given Netflix’s data assets and Microsoft’s programmatic capabilities, Netflix has an opportunity to test, learn, optimize, and personalize the creative experience to find success within the ad-supported streaming landscape.

Partnerships will be critical to ensure Netflix does not become another walled garden. Overcoming streaming channel fragmentation requires collaboration with identity and addressability tech enablers whose connective solutions can bridge the fragmented CTV landscape of OEMs and support more holistic media plans that advertisers expect.

Trust (but verify) your measurement providers. As dozens of new measurement providers, methodologies, and video currencies flood the market, Netflix must ensure that third parties and standards bodies (like IAB Tech Lab and the MRC) are leveraged to ensure that service avoids the criticism of a new entrant “grading their own homework.” Netflix has an opportunity to become a new standard bearer, able to address not only the challenges of proving the value of high-quality audiences and content but also able to address new issues like “Continuous Play” (screen off / device on), which was also a hot topic of debate at VLS. But that is another story for another day.

Our thanks to the following team leads at VLS who helped guide discussions for the “Future of Ad-Supported Streaming.”

Beth-Ann Eason, Managing Director, Accenture Interactive

René Santaella, Chief Digital & Streaming Officer, Estrella Media, Inc.

Scott Schiller, Global Chief Commercial Officer EMX/Big Village, and Adjunct Professor Stern/NYU

September 16, 2022